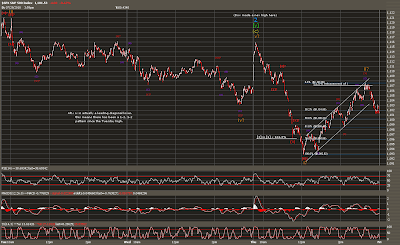

Labellings have been added to yesterday's update but no labellings have been moved. Minor wave 3 should now be underway after a truncated v wave today completed zigzag wave [y] of double wave 2. Prices should continue lower tomorrow in an impulsive fashion.

Note the wave crossing over the mid-July peak. This is a bearish sign and hints at a complete zigzag since 7/6 (or 7/1), unless a large 3rd wave higher lies ahead.

The 1 minute chart above illustrates what appears to be an impulsive sell-off following the morning gap higher. A sharp retracement of a wave truncated to this degree makes sense. Note that the Dow Jones Industrial Average exceeded the Tuesday level today by a small amount.

The correction today looks like a double zigzag correction that is contained well within a channel (impulse waves usually break out of channels in the direction of the trend).

The larger view has not changed.

blog comments powered by Disqus