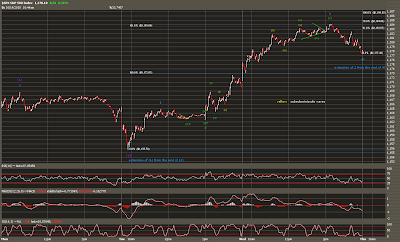

The market rallied above the 1176 and 1180 areas today with ease invalidating the ending diagonal count presented in yesterday's update.

More than 78.6% of the decline since April has been retraced with new upward momentum in the market. Because of this, there is little reason to believe the rally since March 2009 has completed. After spending most of the day thinking about options, the above count is now the primary.

Notice the proportionality between waves with alternation of subdivided and non-subdivided impulse waves within the zigzags. The count also respects the fine structure of the waves not visible on this scale, all the way down to the 1 minute time frame. In other words labels have been rearranged but the findings in the 60 minute, 5 minute, and 1 minute scales have not been forgotten.

The count features a "3rd of a 3rd" wave today that is the core of the entire rally since 8/31. This implies a continuation of the slow moving rally for weeks or months more. This would be an astonishing pattern if it actually unfolds as it should be larger than the February-April rally.

There is an alternate count, but it still calls for a rally into next week. An impulse since 10/4 will complete the alternate count's advance since March 2009.

In the shorter term, a series of upward impulse waves work well.

Prices should advance tomorrow above today's high. Because corrective 2nd and 4th waves usually alternate in form, after tomorrow's peak, look for sideways wave (4) consolidation which will probably complete Friday. Keep in mind that there have not been any triangles in quite a while, so do not be surprised if wave (4) is a triangle.

blog comments powered by Disqus