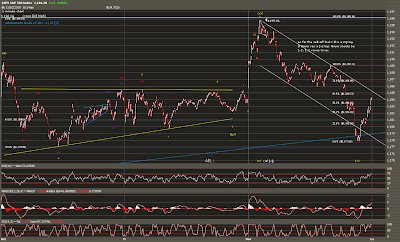

In Friday's Update, a gap higher was expected Today that would be the entirety of (c) of [v]. While it appears that (c) did complete in the morning hours, symmetry in the move higher is evident when labelling a (b) wave triangle as illustrated above.

Using the larger count, the selling that followed should be the start of a new bear market following a complete wave C. Zigzag wave (x) of double zigzag wave [v] of C is the alternate view. Even with the structural concern to the sell-off today (it resembles a zigzag), it seems probable that C is complete. It is crucial that prices turn quickly tomorrow to support this view however. From an Elliott wave perspective, there will be very good reason to believe C is complete with a move under today's low (1177.65) tomorrow. Obviously a loss of wedging (under 1174 at the open) and a move under 1171 will be even stronger evidence to support a complete top.

Prices double topped at 1196 today. If selling resumes tomorrow, 1195.81 should be the final top of the entire rally since March 2009.

As a point of interest, the upper Bollinger Band was reached again today with the band contracting on both sides. Following several days of sideways action, the band is very narrow at this point and should begin expanding soon. Increasing volatility will account for this expansion. The expected direction is down with the current market and band resembling the April highs.

blog comments powered by Disqus