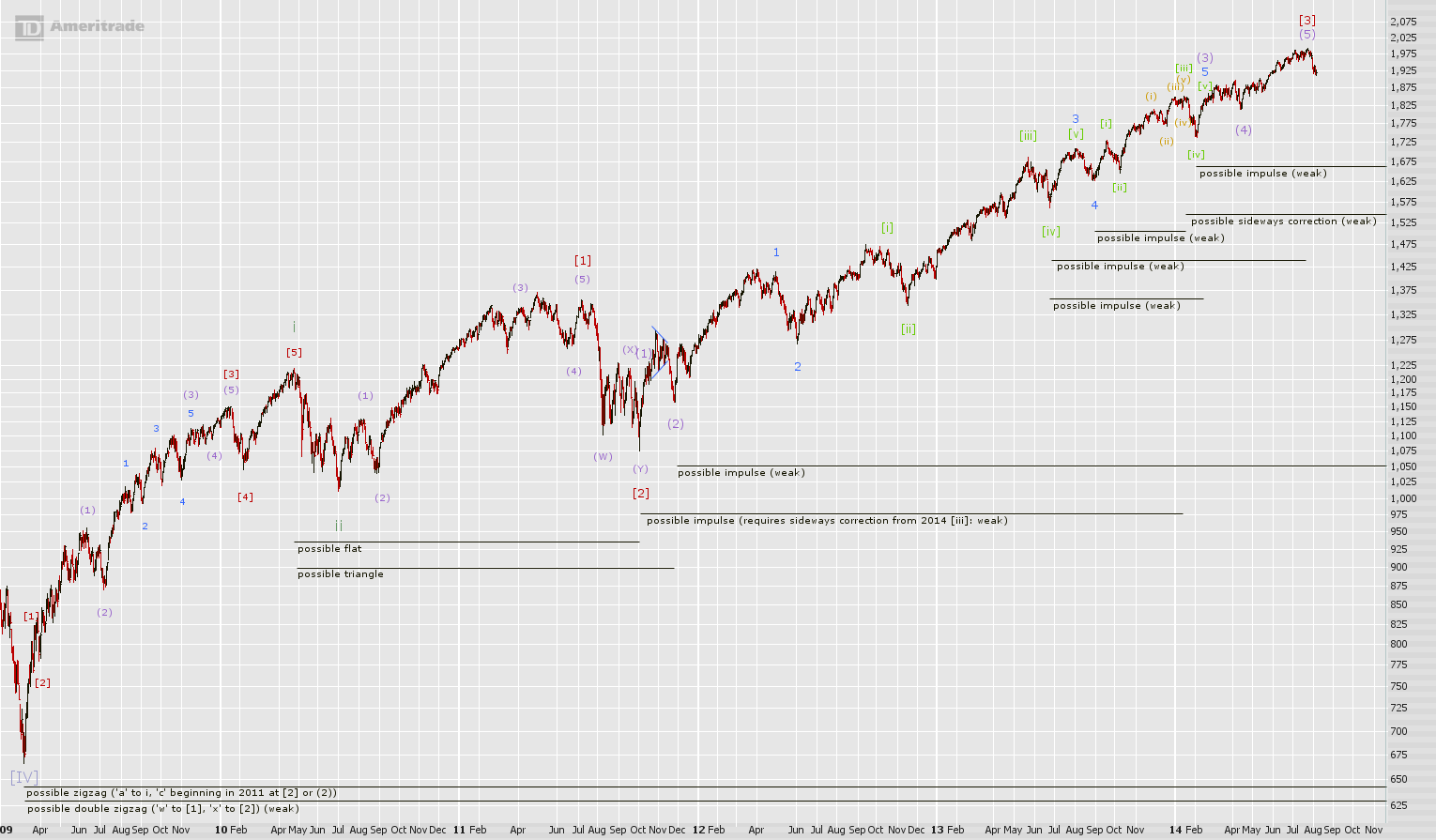

As usual we begin with an analysis of the longer-term waves and work to the shorter-term. If there is a triangle from i to (2) in 2011, the market can continue to make new all-time highs or can break down from [3]. A triangle implies a zigzag began at the 2009 low an the market will break down to levels likely under 1000. The triangle option works best with the (1) and (2) waves, but it is forced to use a non-favorable option for an impulse higher following (2). If there is a flat from i to [2], a zigzag higher since 2009 is still possible, but this could also just be a 2nd wave of a larger impulse.

A detailed discussion of the wave structure possibilities beginning at [2] or (2) can still be found here. The following was concluded:

"First, a sideways corrective wave lower from 2014 [iii] is a reasonable possibility worth considering when used as a 4th wave that is paired with 2nd wave [2]. But the problem with this sideways correction is that price has rallied so far above [iii] with the ‘b’ wave being quite large relative to ‘a’. So it has been labeled “weak”, but just barely given that the larger impulse structure it is a part of is not bad.

An impulse higher unfolding since 2014 [iv] is weaker than the sideways pattern due to its complexity and the structural concerns within the larger impulse higher since 2011. This possibility is on-par with a pullback of similar size of (2) following (5)’s completion, then another impulse higher following; or a 2010-11 triangle with impulse higher completing at (5).

The poorest options involve an additional stretching of the impulse wave higher since 2011 where a 5th wave extension is taking place or the core of the impulse wave is in wave 5 territory. These are the remaining options discussed above.

The wave count in color is strongest because the other possibilities have at least one undesired feature that it does not have. It stands out by a good amount in this regard."

To read much more including my medium- and short-term work, the work other writers and our collective opinion, please visit http://ewaveanalytics.com and take advantage of our free trial.

blog comments powered by Disqus